Year-End Tips 2022: 11 Tips for Directors/Major Shareholders (DGAs)

Year-End Tips 2022: 11 Tips for Directors/Major Shareholders (DGAs)

What tax-related steps do you need to take before the end of the year or what would be better to postpone until the new year? This is the perfect time to check the most important tips for Directors/Major Shareholders.

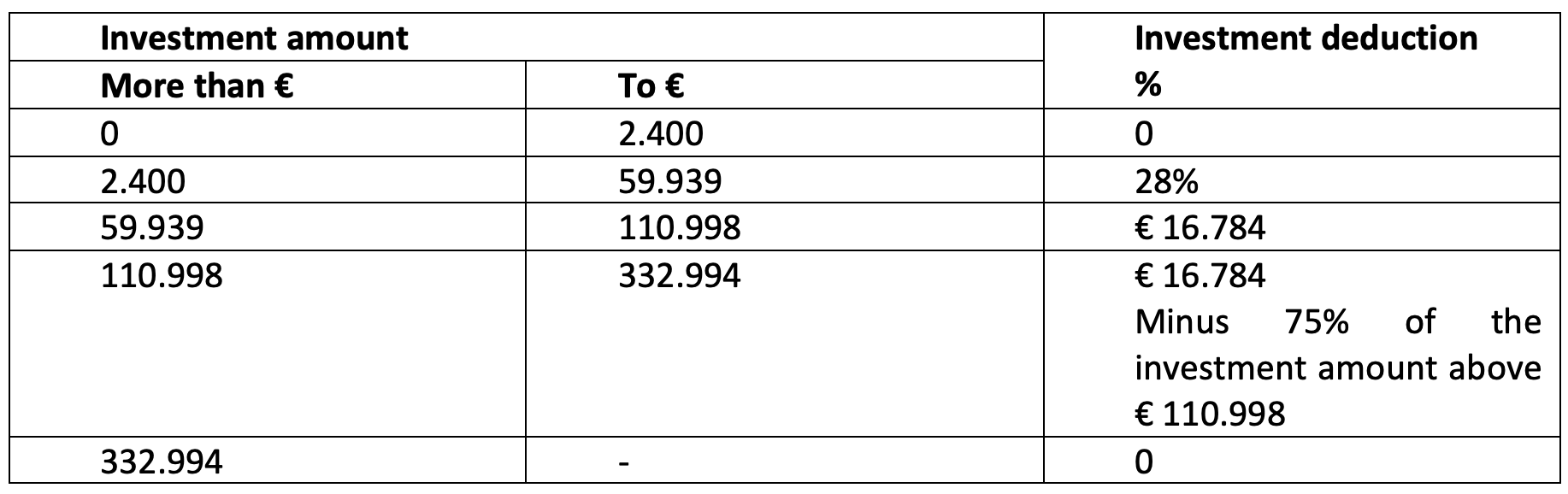

1. Small-scale investment allowance (KIA)

Have you already invested enough in business assets in 2022 to qualify for the small-scale investment deduction (see table below)? If not, there may still be some tax benefits to be gained! To be eligible for this investment scheme, an investment must amount to at least € 450 excluding VAT.

2. Breaking up of the fiscal unity as of December 31, 2022

If you no longer wish to be part of a fiscal unity (fiacale eenheid) for corporate income tax purposes as of 1 January 2023, the request for deconsolidation must be submitted no later than 31 December 2022. This can be advantageous in certain cases when there are several profitable companies in a fiscal unity. In this way, the companies can individually use the lower bracket in corporate income tax. However, the benefit will be considerably less in 2023. Due to a measure in the 2023 Tax Plan, the lower bracket will be shortened from € 395,000 to € 200,000 from 2023, and the rate in this bracket will also be increased from 15% to 19%. Breaking up a fiscal unity can also lead to the application or increase of the investment deduction. There are of course also disadvantages associated with the breaking up of a fiscal unity for corporate income tax purposes. If necessary, carefully map out these advantages and disadvantages with an advoser before proceeding with deconsolidation. Finally, the breakup of a fiscal unity before December 31, 2022, that was entered into in 2022 is considered to never have existed. Please note: consult your advisor about any tax sanctions that may come into effect as a result of the break-up of the fiscal unity.

3. Borrowing from your B.V. (including current account)

As a director-major shareholder (DGA), you can finance your investments with a loan from your B.V. The loan is then, just like the investments, in box 3. The borrowing must take place under arm’s length conditions, part of which is a written record. Discuss with your advisor which conditions you still need to agree on. If you took out the loan for the owner-occupied home, the interest is deductible if the loan qualifies for tax purposes as a home acquisition debt in box 1. As a DGA, do you have a structurally high current account debt with your B.V.? Then you run the risk that the Tax and Customs Administration will designate (part of) the debt as a dividend payment and make a correction, possibly even increased by a fine. You can reduce this risk by ensuring proper documentation.

Please note: In 2023, under the legislative proposal, you and a possible partner can only borrow a maximum of € 700,000 untaxed from your own company. Loans intended for the owner-occupied home are excluded from this scheme and will not be taken into account. The first test date will be December 31, 2023, so you have until this date to repay debts above the limit, otherwise the excessive part of the loan will be taxed at a rate of 26.9% in box 2 as if it were a dividend payment.

4. Provision

Do you want to postpone profit taking? Check if you can still form a provision. For this it is sufficient that the future expenditure originates in facts and circumstances that occurred before the balance sheet date, and that there is a reasonable degree of certainty that the expenditure will be incurred in the future. Furthermore, future expenses must also be allocated to the period prior to the balance sheet date. Provisions are possible, for example, a reorganization, maintenance, remediation costs, guaranteeing products or jubilee expenses for staff. Incidentally, postponing profit-taking in 2022 is less interesting for tax purposes than in the previous calendar year, now that the low corporate income tax rate will be increased from 15% to 19% in 2023 and the threshold will be lowered from € 395,000 to € 200,000.

5. Last payroll tax return 2022

Verify that all payments made to staff have been properly remunerated. This also includes the fixed additions for the delivery van and the passenger car, and other favorable forms of remuneration.

6. Last fiscal year VAT return

When preparing the last tax return of the financial year, please bear in mind the following points. Private use related corrections:

- Correction of VAT for private use of a car (both for you as an entrepreneur and for your staff);

- Correction of VAT for private use, for example, gas, water, electricity and heat;

- Correction of VAT for use by you as an entrepreneur of goods belonging to the company for purposes other than business purposes (including private use, for example, business assets that you use for both business and privately);

- Correction of VAT for the provision of services by you as an entrepreneur for purposes other than business purposes (including private use);

- Correction in the context of the company canteen scheme;

- Other corrections to the deduction of input tax on benefits in kind to staff (providing the opportunity for sports or relaxation, private transport and housing) and for promotional gifts and

Pro-Rate Related Adjustments:

- Entrepreneurs who do not exclusively perform VAT-taxed services must calculate the pro rata deduction percentage for the past year. This can lead to a correction (up or down) of the previously deducted VAT on general costs.

- If the pro rata deduction percentage falls below 90% (or 70% for travel agencies, among others), you must assess the consequences for any ‘taxable rent options’ in rental contracts.

- A review of input tax must take place on movable and immovable investment goods.

In some cases it is approved, subject to conditions, that the corrections can take place at the end of the calendar year (if the calendar year is not the same as the financial year).

7. Deadline for reclaiming foreign VAT

Are you economically active in several EU countries? Dutch entrepreneurs who are entitled to a deduction can reclaim VAT paid in other EU countries via an electronic request to the Tax and Customs Administration. Please note: Separate login details are required for this and it can take several weeks to process this request. The request must be received no later than September 30 of the year following the year for which you are reclaiming VAT. Requests received after this date may no longer be processed by the other EU country.

8. Employee car costs (VAT)

If the employer makes a company car available to employees, the employer is in principle entitled to a full VAT deduction on the car costs. However, at the end of the financial year, the employer must declare a VAT correction for private use. This means that an employer owes a fixed correction of 2.7% of the catalog value of the car for every car that is used privately. Under certain conditions, it is possible or even obligatory to deviate from the fixed correction and to match the actual private use. Commuting also counts as private use for VAT purposes.

9. Debtor does not pay, reclaim VAT

VAT paid without the invoice ever being paid? If a debtor does not pay you, you can, under certain circumstances, reclaim the VAT that you have already paid to the Tax and Customs Administration. Please note: if you make agreements with your debtor about the payment of the invoice, your claim may be converted into a loan. In that case, you cannot submit a request for a refund to the Tax and Customs Administration. Before you propose a payment arrangement, you should, therefore, carefully check whether your debtor will eventually meet his obligations or not. You must submit the request for a refund in time. This means within one month after it is clear that your customer is not paying. At the latest, one year after the claim becomes due and payable, it is deemed that the debtor will no longer pay and you must reclaim the VAT.

10. Retention

Cleaning up and destroying old administrative data can of course save you money, but do take into account the statutory retention period of at least seven years for your administrative data. With regard to immovable property and rights to which it is subject, you must even keep the VAT accounts for ten years. In certain cases, VAT is subject to a special retention obligation (of ten years) when telecommunication, broadcasting and electronic services are offered cross-border. A retention period of ten years also applies if you use the one-stop shop/OSS scheme. Permanent documents (deeds, pension and annuity policies, etc.) should not be thrown away. Tip: if you save the details of sales receipts digitally and can make them available to the Tax and Customs Administration, it is no longer necessary to keep receipts, receipt rolls and suchlike on paper. This also applies to invoices, provided that no information is lost during scanning.

11. Substantial increase in maximum premium income

The increase in the statutory minimum wage by a percentage of 10.15% (!) necessitates a substantial increase in the maximum premium wage. Please bear in mind that the maximum premium income for employee insurance and the Health Insurance Act will increase from € 59,706 in 2022 to € 66,956 in 2023.

More Year-End Tips 2022

For Directors/Major Shareholders (DGAs)

For Business Owners

For Private Individuals

Main office

Hoofdstraat 2

2351 AJ Leiderdorp

The Netherlands

call us

+31 (0) 71 54 22 720