Year-End Tips 2022: 8 Tips for Business Owners subject to income tax rules

Year-End Tips 2022: 8 Tips for Business Owners subject to income tax rules

What tax-related steps do you need to take before the end of the year or what would be better to postpone until the new year? This is the perfect time to check the most important tips for Directors/Major Shareholders.

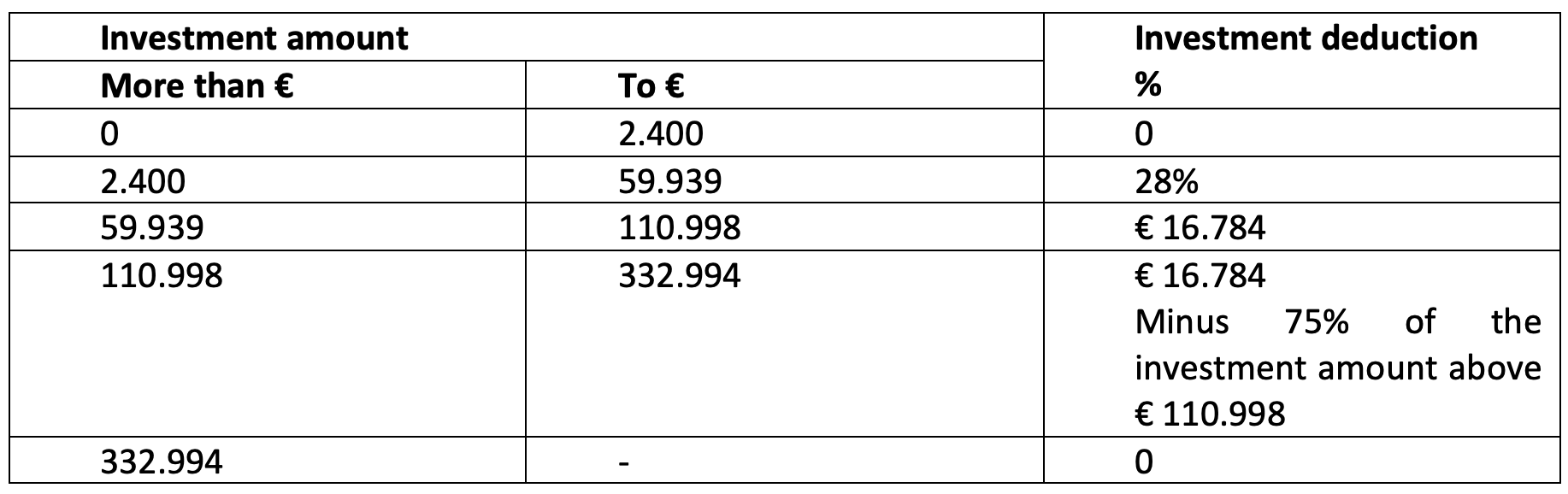

1. Small-scale investment allowance (KIA)

Have you already invested enough in business assets in 2022 to qualify for the small-scale investment deduction (see table below)? If not, there may still be some tax benefits to be gained! To be eligible for this investment scheme, an investment must amount to at least € 450 excluding VAT.

2. Last payroll tax return 2022

Verify that all payments made to staff have been properly remunerated. This also includes the fixed additions for the delivery van and the passenger car, and other favorable forms of remuneration.

3. Last fiscal year VAT return

When preparing the last tax return of the financial year, please bear in mind the following points. Private use related corrections:

- Correction of VAT for private use of a car (both for you as an entrepreneur and for your staff);

- Correction of VAT for private use, for example, gas, water, electricity and heat;

- Correction of VAT for use by you as an entrepreneur of goods belonging to the company for purposes other than business purposes (including private use, for example, business assets that you use for both business and privately);

- Correction of VAT for the provision of services by you as an entrepreneur for purposes other than business purposes (including private use);

- Correction in the context of the company canteen scheme;

- Other corrections to the deduction of input tax on benefits in kind to staff (providing the opportunity for sports or relaxation, private transport and housing) and for promotional gifts and

Pro-Rate Related Adjustments:

- Entrepreneurs who do not exclusively perform VAT-taxed services must calculate the pro rata deduction percentage for the past year. This can lead to a correction (up or down) of the previously deducted VAT on general costs.

- If the pro rata deduction percentage falls below 90% (or 70% for travel agencies, among others), you must assess the consequences for any ‘taxable rent options’ in rental contracts.

- A review of input tax must take place on movable and immovable investment goods.

In some cases it is approved, subject to conditions, that the corrections can take place at the end of the calendar year (if the calendar year is not the same as the financial year).

4. Deadline for reclaiming foreign VAT

Are you economically active in several EU countries? Dutch entrepreneurs who are entitled to a deduction can reclaim VAT paid in other EU countries via an electronic request to the Tax and Customs Administration. Please note: Separate login details are required for this and it can take several weeks to process this request. The request must be received no later than September 30 of the year following the year for which you are reclaiming VAT. Requests received after this date may no longer be processed by the other EU country.

5. Employee car costs (VAT)

If the employer makes a company car available to employees, the employer is in principle entitled to a full VAT deduction on the car costs. However, at the end of the financial year, the employer must declare a VAT correction for private use. This means that an employer owes a fixed correction of 2.7% of the catalog value of the car for every car that is used privately. Under certain conditions, it is possible or even obligatory to deviate from the fixed correction and to match the actual private use. Commuting also counts as private use for VAT purposes.

6. Debtor does not pay, reclaim VAT

VAT paid without the invoice ever being paid? If a debtor does not pay you, you can, under certain circumstances, reclaim the VAT that you have already paid to the Tax and Customs Administration. Please note: if you make agreements with your debtor about the payment of the invoice, your claim may be converted into a loan. In that case, you cannot submit a request for a refund to the Tax and Customs Administration. Before you propose a payment arrangement, you should, therefore, carefully check whether your debtor will eventually meet his obligations or not. You must submit the request for a refund in time. This means within one month after it is clear that your customer is not paying. At the latest, one year after the claim becomes due and payable, it is deemed that the debtor will no longer pay and you must reclaim the VAT.

7. Retention

Cleaning up and destroying old administrative data can of course save you money, but do take into account the statutory retention period of at least seven years for your administrative data. With regard to immovable property and rights to which it is subject, you must even keep the VAT accounts for ten years. In certain cases, VAT is subject to a special retention obligation (of ten years) when telecommunication, broadcasting and electronic services are offered cross-border. A retention period of ten years also applies if you use the one-stop shop/OSS scheme. Permanent documents (deeds, pension and annuity policies, etc.) should not be thrown away. Tip: if you save the details of sales receipts digitally and can make them available to the Tax and Customs Administration, it is no longer necessary to keep receipts, receipt rolls and suchlike on paper. This also applies to invoices, provided that no information is lost during scanning.

8. Substantial increase in maximum premium income

The increase in the statutory minimum wage by a percentage of 10.15% (!) necessitates a substantial increase in the maximum premium wage. Please bear in mind that the maximum premium income for employee insurance and the Health Insurance Act will increase from € 59,706 in 2022 to € 66,956 in 2023.

More Year-End Tips 2022

For Directors/Major Shareholders (DGAs)

For Business Owners

For Private Individuals

Main office

Hoofdstraat 2

2351 AJ Leiderdorp

The Netherlands

call us

+31 (0) 71 54 22 720